If the value of your home is lower than your home loan or cost, you’re probably thinking, “how did I get myself into this mess?” You maybe feeling like there was something you could have or should have known. But what we were told about the financing of real estate was in fact never true. In reality, the rapid growth of the housing market is an artificial creation based on well-established secretive relationship between banks and government. How the imported home loan bubble actually fly here in a nutshell: the private bank deliberately delay resolutions, push its casual AI Bots, assuming and dreaming that ageing home owners eventually can be threatened / extorted to pay accrued interests or principal, as per its SOP diktat. Those who cannot pay, the 25 year game-plan opens huge opportunities for foreclosure profiteering trade, sucking what you paid, secondary loan market auctions, soft legal jugaad, white-collar goons, Fringe financing, institutional slavery, etc..

Sure, noone can escape the need for shelter. But this basic need is entangled with our fervent belief in the deep state system and its tactical game theories. The big data driven story starts when the government decide to partner with private banks (PPP) and “West India Company” bhakts to boost housing market. Since then, we’ve been believers in a fantasy that has driven millions of dwellers to take on more and more debt just to have a home to live in. Earlier many did not own their homes nor have any hope of doing so. If you wanted to join the league of landlords, you would either have had to pay cash, or to have known someone who would lend you the money. The lender could be a bank, but only if you had a good relationship with banker. And even then, they would only allow you to borrow 50% of the property value and you had to pay it off in three to five years.

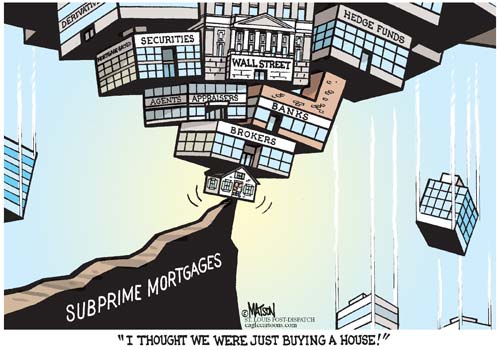

With household income on the rise, the financial mafia (NRI-Gujju type cats with political bonds) are selling dreams that home ownership is key to unlocking growth and creating new jobs. This encouraged banks partnering with government so they could profit immediately rather than waiting for the mortgage or loan to be paid in full. Payment terms were extended to 20-30 years. Of course, creation of home loan expands the market enormously, but unfortunately only for benefit of insider capitalists.

The reality of growing ownership is a shifting burden of risk from business and publicly subsidized housing to you, the individual “property owner.” In addition to creating / drumming “society of home owners,” the expanding mortgage market creates a “society of debtors“. Instead of building affordable housing, checked by ability to pay for a home in a relatively short period of time, prices grows to accommodate longer payment terms.

Although you can book with a down payment of only 5% of home value, they’ll charge you higher interest rates and require buying of additional loan insurance. Banks design complicated products including adjustable rate mortgages, interest-only payments, negative amortization and hybrids of all three. And the government will never tell you that if public agencies will operate as a secondary loan market (allowing more banks to sell their selfie risk immediately), situation can become worse for your kids after 25 years. They are dumping you with all the risks and banks with all the gains, which gets routed to mafia smarties via transfer to middle-men like Nirav Modi, Vijay Mallaya, etc..

So, actual levels of ownership only expands by a few percent. Very few new home owners will be created. If you were under the impression that the housing market could grow perpetually, you were not alone. We were told time and time again that, in the housing market, what went up would never come down. Too bad they forgot to mention that the banks wouldn’t lose if you couldn’t pay. And, oops, they also forgot to mention that you would be paying as a taxpayer, even though you also lost everything as a home owner. It’s hard to believe that either the bankers or the government officials believed the market could grow forever. To the contrary, the reason they developed the laws and financial schemes they did is because they knew it could not continue to grow forever.

The realization that ownership does not instantly occur when you signup for a home loan has been exposed by the banking epidemic. The reality is that the bank owns the property and you’re really only purchasing an opportunity to become an owner, assuming all goes well in the kingdom for 25 years – ready for a long-gamble?

If not, blame banking industry for developing complex financial instruments designed to tempt and confuse borrowers like some adjustable rate mortgages (ARM) – you receive an initial interest rate that adjusts after several years. These loans frequently allow you to choose whether to pay the full monthly payment or just the interest. They are often combined with home equity lines of credit. These loans can cause the principal to increase if you make reduced payments. Even after the collapse, the predatory nature of the ARM is still being revealed – these rates are set against the LIBOR index, which is manipulated by the major banks in scams.

Such loans were most often used by growing masses of freelancers, informal gigs and precarious workers, etc – many of whom did not qualify for a traditional home loan from lesser evil public banks. Certainly, ARMs and stated income loans have high rates of failure, but the causes for the financial collapse are much more complex and cannot be blamed on the purchasers of these complicated loans. Rest assured, these so-called banks (extortionists in reality) will never address its staff, its mistakes, its blunders, its calculations, its delays, its opaque policies, its assumptions as long they gets pat from political allies and govt agencies.

There are many reasons property owners might be unwilling to strike back – from the glorified perception of ownership to the taboo against failing to pay debts, to fear of bad credit, to belief that market will improve. Yet as more and more victims of the housing market understand the complicated details of the game our government plays with the banks at our expense, the potential for collective action grows.

2015: An Example Paid Media PR trapping new home buyer preys in millions

India, touted to be one of the fastest growing economies in 2050, saw a modest slump in real estate market. Despite slow growth in initial quarters, real estate sector ended on a high note. After timely intervention by policymakers, real estate market is hopeful of seeing outstanding growth.

So, with regulatory changes including easing of foreign direct investment rules and better execution capabilities, Indian realty is being preferred as an investment destination by global investors. Transparency in processes like online approval will further improve the perception of Indian real estate in the eyes of international investors. This would help them bring in robust inflows of funds in the sector. Indian government’s ambitious “Housing for all by 2022” will see an increase in joint investments by public and private sector to provide affordable housing. Moreover, the vision to develop 100 cities into ‘smart’ cities will provide real estate sector with the robust opportunity to invest in Tier-II and Tier-III cities. Also, The National Highways Authority of India (NHAI) is planning to award many Highway projects under Public-Private partnership.

The decision of reduction of repo rate by RBI, relaxing norms for FDI and clearing way for of The Real Estate Bill by the cabinet etc. are welcome steps. It is also expected that the Reserve bank will reduce the repo rate further in the next year after keeping it unchanged this time. We expect that financial institutions will pass on the benefit (LOL) which has been extended by the RBI in the previous reviews and lending rates will come down. These steps have generated a buzz in the industry and the next year seems to be full of promises. With enough boost from the government and RBI this state of affairs is all set to change. Overall, the stage is set for a stellar show by the real estate sector!!!

Ref: Article 5 of mafia capitalism, Debt Resistance Manual, #JugaadBanks, #CorruptionOfScale

Be vigilant while applying for any loan. A few protocols can safeguard you from loan related frauds. Guidelines to stay safe:

- Never trust offers that seek advance payments or pre-sanction payments for processing loan application

- Do not trust loan offers that provide cash-backs, interest waiver or zero interest rates

- Always ask the loan executive for an identification proof before sharing your documents

- Always follow the process shared by the bank official and verify every document