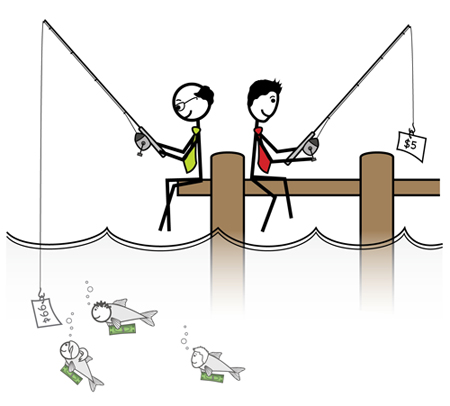

There are now 9 million more renters than there were just a decade ago, the biggest jump in renters on record, and they are paying more for rent than ever before. Of the 43 million families and individuals who rent in US, 1 in 5 are considered cost-burdened or paying more than 30% of their incomes on rent, according to a new study by the Harvard Joint Center for Housing Studies. Others pay half their incomes. The crisis in the number of renters paying excessive amounts of their income for housing continues, because the market has been unable to meet the need for housing that is within the financial reach of many families and individuals with lower incomes. These affordability challenges also are increasingly afflicting moderate-income households. While consultants, agents, builders and mushrooming portals managed by cronies inject hypes for appreciation and enhance their commission bucks!

The crisis in the number of renters paying excessive amounts of their income for housing continues, because the market has been unable to meet the need for housing that is within the financial reach of many families and individuals with lower incomes. These affordability challenges also are increasingly afflicting moderate-income households. Record-setting demand for rental housing due to demographic trends, the residual consequences of the foreclosure crisis and an increased appreciation of the benefits of being a renter has led to strong growth in the supply of rental housing over the past decade both through new construction and the conversion of formerly owner-occupied homes to rentals.

As more supply comes to market in large cities, rents are starting to moderate, but, again, that is in the higher end, luxury space. Some developers are starting to look to secondary markets and suburbs for new projects, since demand continues to be strong, but unlike the single-family construction market, the timeline for new product to reach the market in multifamily is several years out. For the middle class, the largest investment people have is equity in their home. By allowing home prices to rise, politicians increase net worth of the middle class. If they allow home prices to fall, middle class wealth goes down. As a result the government tends to get overly involved in making sure prices do not go down and if they happen to go down they do anything they can to minimize the impact that has on home owners. Such as mortgage modifications or excluding income from tax and so forth. The government can let prices do what they will without government manipulation. Are you so dependent upon the government that you can’t accept personal responsibility for your own gains or losses?