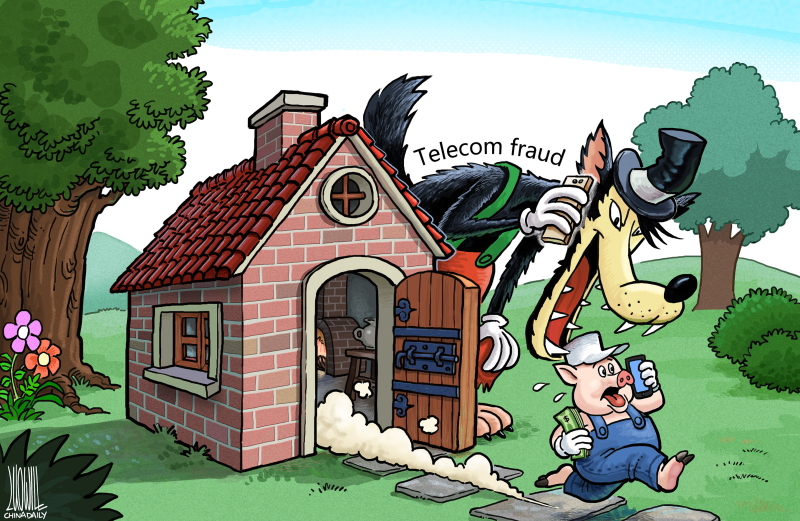

Lesser the number of telecom players, its easier for the Govt to manage privacy data abuse with outstanding stealth. Are the consumers being deliberately pushed to the mercy of telecom oligarchies subservient to malicious political intents? Its not unusual for the smart gangs to manufacture network problems and outages with Vodafone Idea for achieving the desired goals and extorting more money by increasing data price from end consumers. Many smaller competitors were already strategically buried earlier. But if BSNL or MTNL benefits due to the current crisis instead of Jio or Airtel, some good long-term prospects.

Telecommunications industry is one of the most profitable and rapidly developing industries in the world. Telecommunication industry deals with various forms of communication mediums, for example mobile phones, fixed line phones, as well as Internet and broadband services. The telecom companies have opted for Mergers and Acquisitions (M&A) as a strategic tool to enhance their performances. Private and FDI have also boosted the growth of merger and acquisition.

The telecom service providers are keen to adopt policy of Merger and Acquisitions as this helps in cutting down of their expenses, achieve greater market share and accomplish market goals along with economies of scale. In addition, it helps in building of infrastructure in more convenient way, offers extensive networking advantages. Builds Brand Value and bigger client base.

In Europe Region the following merger and acquisition have showcased a satisfactory growth in the telecommunication sector.

· In France, Orange’s bid for Spanish broadband provider Jazztel has been held up by regulators, while the UK BT Group is adding mobile to its range of products after agreeing in February 2015 to pay about USD 19.0 billion to Deutsche Telekom and Orange to buy their wireless carrier EE.

· Swedish network equipment provider Ericsson has completed its acquisition of UK media services provider Red Bee Media, following approval of the deal from the UK Competition Commission on 27 March 2016 and establishing UK as a “major global media hub” for Ericsson.

· In the Nordic region, Sweden’s TeliaSonera received approval in February 2015 to buy Norway’s Tele2, and is awaiting the nod to merge its Danish business with Norway’s Telenor.

· Spanish media group Prisa has accepted incumbent operator Telefonica’s Euro 725.0 million bid for its 56.0% stake in pay TV platform Canal+’s holding company Distribuidora de Televisión Digital (DTS)

· The number of The UK mobile telecommunications providers is shrinking with purchase of Telefonica’s 02 divisions by Hong Kong’s Hutchison Whampoa on March 24, 2015, reducing the number of wireless networks to three from four.

In Asian Countries such as India, M&A’s have increased to a considerable level from mid 1990s. The first deal happened in 1998 between Max Group of Delhi and Hutchison Group of Hong Kong. The well-known mergers and acquisitions in the telecom sectors include:

· Acquisition of Command Cellular Services by Hutchison from Usha Martin on July27, 2000.

· Acquisition of stakes in Idea cellular by Aditya Birla group from the Tata group on June 20, 2006, merger of Aircel Ltd. with G T L Infrastructure Ltd on Jan 15, 2010.

· Acquisition of Hutch services in India by Vodafone on 11 Feb’2007.

· Bharti Airtel announced acquisition of Warid Telecom after getting approval from Uganda’s Telecommunications Regulator in 2013 enabling company to strengthen its footprint in African region, and acquired Loop Mobile on November16, 2014, a deal that made the telecom the major top operator.